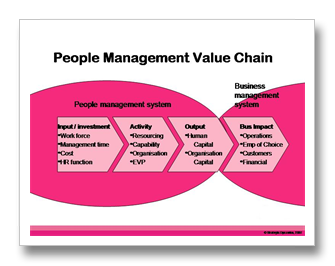

In the value chain model the basic logic of value creation is the transformation of input into products, mainly through sequential processes. The evaluation of the product and related services is the source of customer value. An example is the assembly line using long-linked technology to produce standard products at low cost. Primary activities of a value chain banks are inbound logistics, operations, outbound logistics, marketing & sales, and service.

In the value shop model the basic logic of value creation is problem solving. Value is created by mobilizing resources and activities to resolve a particular customer problem. Customer value is not related to the solution itself, but to the value of solving the problem. Examples of value shops include doctors and consultants. The primary activities of a value shop are a cyclical or spiraling process of problem-finding and acquisition, problem-solving, choice, execution and control/evaluation.

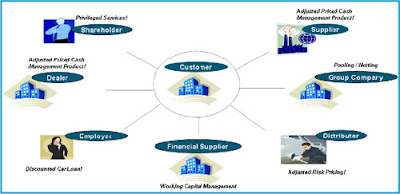

In the value network model the basic logic of value creation is linking customers. Linking, and thus value creation, can be direct between two customers, or indirect where one customer is not linked directly to another customer but linked through a pool. Value networks rely on a mediating technology to link independent customers. The primary activities of a value network are network promotion and contract management, service provisioning, and network infrastructure operations. The primary activity network promotion and contract management consists of activities related to attracting and selecting customers and to managing the customer relationship, in particular contracts related to governing service provisioning and pricing. Service provisioning is linking customers to one another and charging for the services provided. Network infrastructure operation consists of activities related to maintaining a physical and informational infrastructure.

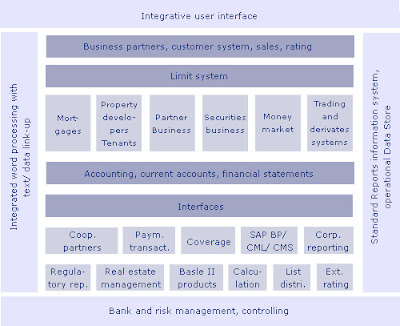

It has been argued that form follows function in the ongoing transformation of banking. The global financial system project at Harvard defined six core needs served by a financial system: methods of making payments in order to facilitate the exchange of goods and services; mechanisms for pooling resources to fund large scale enterprises; ways to transfer economic resources over time and across distances (e.g. lending and investing); methods of managing risk (e.g. insuring, diversifying and hedging); price information (e.g. interest rates and securities prices, to help coordinate decentralized decision making in various sectors of the economy); and finally, ways to handle incentive problems that interfere with business transactions (ibid). Each of these functions meets a basic need, and many of the services offered by banks involve more than one of these needs. For instance, when banks take deposits they combine payment and pooling functions. Lending includes transfer of economic resources with risk management. A payment may combine payment, pooling and transfer functions. Without these functions, the modern bank is unthinkable. Building on these functions, a bank can be thought of as a mediator in a network of customers that are best modeled by the value network configuration. However, implementation of self-service banking differs in scale and scope, and we will discuss below how the three configurations can be applied to self-service banking.

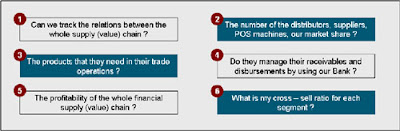

An online replica of the traditional full-service bank is best viewed as a value network since the Internet does not alter any of the basic characteristics of this value configuration. The implication for self-service banking is that the site must support the primary activities of a value network. Network promotion and contract management are necessary in order to recruit new customers into the network and to maintain the relationship with existing customers. Network promotion may include placing banner ads on websites that reach your target groups with links to automated processing of new customers. Contract management applies to changes and renewals of existing contracts. Service provisioning is offering self-service technology that enables customers to perform banking services as self-service. Infrastructure operation is running the operation of the self-service banking platform.

Viewing banks as value shops implies that banks solve problems for their customers – and that these problems are unique to each customer. We will argue that the advisory services for investments, as well as to a certain extent loans, and financial planning share the characteristics of problem solving as defined in the value shop model. Selfservice in a value shop model is a demanding concept because the customers will be their own experts. As a consequence a bank has to give up its information asymmetry relative to its customers to enable them to give themselves expert advice. The following is a scheme of how the primary activities of a value shop can be supported by self-service. In problem finding and acquisition the customers must be supported by training programs for the financial products, enabling the customer to recognize the task at hand and how it may be carried out. Subsequently, selfservice in problem solving can be in the form of offering the customers tools for financial modeling for analysis of potential investments, portfolio management of personal finances, and mortgages. Templates and wizards can make these systems easy to use for the non-professional user. In the choice stage, the model has to include a decision aid that helps the customer choose between alternative solutions, based on the customer’s own criteria. Then, the customer should be able to execute the decision he/she made. In control/evaluation the customer has access to benchmarks concerning how successful the decision was, and for a complex service that includes many steps, the customer can monitor the progress of service execution. Self-service banking in a value shop concept can be embedded in a value network model, or offered as a stand-alone service from a niche player.

In the value chain banks model the focus is on production and throughput in the transformation of inputs into products and services. Self-service solutions should support this transformation, but the author has not been able to identify banking services that share the properties of a value chain. Processing payments, transportation of cash, servicing ATM’s are all examples of processes that can be described “Self-service banking” as sequential workflows. However, neither of these processes creates value by transforming inputs into products. Production and distribution of credit cards is an example of a value chain process – between the bank and the card supplier. The value for the customer is not created when the card is issued, but whenever the card is used to pay for a product or service. The conclusion is that the value network and the value shop are potential value configurations for selfservice banking, while it would not be appropriate to use the value chain banks model.